I wrote about the Indian banking sector where I briefly described the journey of Yes Bank. A private bank which grew rapidly from 2014 to 2019, almost collapsed by the end of 2019, and has since been recovering.

Read Here:

Coming back to Yes Bank - Let’s start with the fact that the bank never collapsed, it was saved before it could. As it recovers, I want to talk about why I think it was 'saved too much' and what I mean by it.

The saving went a little too far. Capital poured in, and in 3 years since it hit rock bottom, it had raised ~INR 44,000 crore of capital, all through equity. This left the bank with a much healthier balance sheet.

If hypothetically, the 4 years of chaos - 2019 to 2023, were removed from the market's mind, and you looked at Yes Bank as a bank on the verge of a growth spurt, with a well established network of 1,192 branches, a strong brand value among India's affluent, and a rather conservative management, you would probably value it more reasonably. That's what I'm trying to do.

Yes Bank: The Downfall

It was simple - Yes Bank lent recklessly, and eventually, the loans turned bad. By the end of 2019, its total advances were were over 106% of the total deposits. By March 2020, its gross non-performing assets (NPAs)* had spiked to 16.8%

*A loan is classified as an NPA when interest and/ or instalment of principal remain overdue for a period of more than 90 days in respect of a term loan

Mission: Save Yes Bank

In March 2020, the RBI asked the State Bank of India (SBI) to acquire 49% stake in Yes bank. Let's understand how this changed the capital structure of Yes Bank, give it the cash it desperately needed.

Yes Bank had ~1255 crore shares of INR 2, which meant its equity share capital was INR ~2510 crore. Of this, SBI picked up the biggest chunk of 605 crore share (48.2%). It bought these shares at INR 10 per share, therefore raising INR 6050 crore for Yes Bank.

Other private banks up significant stakes too raising another INR 3940 crore capital by buying the shares at INR 10 per share.

Therefore, in this series of investments, Yes Bank raised close to INR 10,000 crore of capital.

In July 2020, Yes Bank issued 1250 crore additional shares worth INR ~2500 crore, through a follow on public offering pricing the shares at INR 12-13.Therefore, the effective equity share capital went up to INR ~5010 crore. With this FPO, Yes Bank raised another INR ~15,000 cr.

Asset Reconstruction - Cash for NPAs

Between March and June 2020, Yes Bank reduced its gross NPAs from 16.8 percent to 13.4 percent as a portion of its total advances.

It planned to transfer INR 48,000 crore worth stressed loans to the ARC JC Flowers, under the 15:85 structure for ₹11,183 crore.

Private Equity - The Lords and Saviors

In 2022 it approved the allotment of equity shares and warrants of ~INR 8,887 crore (~US$1.1bn) through a preferential issue to private equity investors - Carlyle and Advent International. Equity shares amounted to a stake of 9.99%, while warrants (if converted) would amount to stake of further 7.95%.

For this, Yes Bank proposed to issue ~INR 370 crore equity shares on a preferential basis at a price of INR 13.78 per share and INR 257 crore warrants convertible into equity shares at a price of 14.82 per warrant, to Caryle and Advent each, adding INR ~8,900 crore to the equity capital base of the Bank.

In May 2024, all warrants were converted to equity shares, adding INR 1254 crore of equity capital, and the Caryle and Advent own the full 17.94% as proposed.

Therefore, since the RBI intervention in 2020, Yes Bank capital structure has changed significantly. It has issued equity capital and sold off its bad loans to the ARC, to infuse cash into the system.

Summarizing the Fund Raising:

SBI Led Consortium (March 2020): INR 10,000 crore

FPO (July 2020): INR 15,000 crore

Asset Reconstruction (March 2022): INR 11,000 crore

Private Equity (May 2024): INR 8900 crore

Therefore, between 2020 and 2024, Yes Bank raised INR ~44,000 crore of capital.

(All figures in INR crores)

It's hard to pinpoint where exactly the INR 44,000 crore of infused capital sits in the balance sheet. But two clear outcomes are evident:

Shareholder's Funds are up INR ~30,000 crore

Cash Balance is up INR ~12,000 crore

Back on Track - Back to business

What does a company do with INR ~44,000 crore of newly found cash? Hopefully, get back to business and drive profitable growth. That's what Yes Bank has done. But has it done enough?

Revenue and Profit, March 2020 to March 2024

Yes Bank has had 3 consecutive years of profitable business from 2022 to 2024. Although revenue has risen steadily, profit margins have been rather stagnant.

The reason I say that it is on the verge of a growth spurt, is that in the latest quarter (Q4 FY24), it posted its highest quarterly profit, since it turned profitable again. Q4 FY24's net profit of INR 451 crore is a significant jump from the last 11 quarters of INR 200-300 crore net profit.

Yes Bank Quarterly Net Profit, 2021 to 2024 (INR crores)

Valuation - The final piece of the puzzle

Yes Bank Return on Equity, March 2020 to March 2024

For comparison, HDFC Bank has an ROE of 17%, ICICI 18.8% and SBI 20.3%.

Historical Price to Earnings, 2014 to 2024

Yes Bank has a median P/E of 20.4, a relatively high valuation compared to most banks which can be attributed to its aggressive growth expectations.

TTM P/E for top banks

To return to its median P/E of 20.4, Yes Bank would have to increase its profit by 2.8x in FY25. That's INR ~3,500 crore.

To get an idea of how likely that is, it we can look at banks with comparable revenue.

The average revenue of the 5 banks (Yes Bank excluded) is ~INR 3,600 crore.

Also, let's look at Yes Bank's revenues and profit before 2019

Yes Bank Revenue and Profit, 2015 to 2018

Yes Bank enjoyed a healthy profit margin of 15-16% in its early years. On a much smaller revenue of INR 25,491 crore, it was able to make INR 4,224 crore of profit. Since its recovery, revenue has increased to already surpass to its pre-downfall level, while profit has stayed tight.

So the question really is, how much time will it need to get back to its pre-downfall margins of 15-16%. I've tried to find banks that went through their own crises and how much time they took to recover from those crises.

Although the nature of the crisis is different for each of them, it is still a good starting point to try and estimate how long Yes Bank could take to complete its recovery.

Turn around banks and how long they took to turn around

It took anywhere between 2-6 years for these banks to turn around. Also, some never recovered, or ran into further problems - Credit Suisse for example.

Scenario Analysis

Yes Bank has already been recovering for 4 years now. Let's look at different scenarios and calculate what the stock price would be for each of them. We will change the following variables to create each scenario:

revenue growth

profit margin,

P/E

Assumptions for the variables are based on the following facts:

Yes Bank's revenue growth between 2022 and 2024 was 21% (annualized)

Yes Bank's latest quarter profit margin was ~8%, while its pre-downfall historical margins are close to 15-16%

Yes Bank's historical P/E median is 20.4, while top private banks are trading at P/E multiples of 15 to 20.

The 3 tables below show what the stock price would be for each of the different permutations and combinations. Numbers are as per the P/E of 57 in June 2024. Expected stock prices are for the end for FY 25.

Stock Price Expectations for P/E 15

Stock Price Expectations for P/E 17.5

Stock Price Expectations for P/E 20

What is driving profitability and growth?

Growth:

Growing Deposits:

From 1.05 Lac Crore in FY 20 to 2.66 Lac Crore in FY 24, means that customers trust Yes Bank with their money again.Growing CASA Ratio: From 26.6% in FY 20 to 31% in FY 24. CASA is the ratio of current and saving account deposits to total deposits. Banks pay less interest on CASA deposits, which means it's good for them to have a high CASA ratio. The overall CASA ratio for banks in India is close to 40%, and it almost equal for public and private banks.

Growing Loan Book:

From 1.71 Lac Crore in FY 20 to 2.27 Lac Crore in FY 24

Reducing Risk:

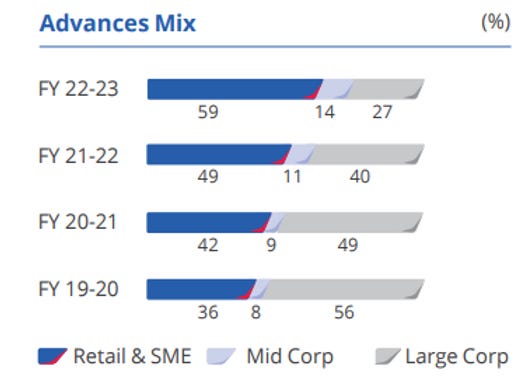

Retailization of Loans: Retailization of loans is basically an act of diversification. Lending smaller amounts to hundreds of individuals and small businesses is better than lending large amounts to a handful of big businesses. Remember, that Yes Bank's downfall started when its big loans to companies like Reliance Power, DHFL, Jet Airways, IL&FS turned bad.

Capital Adequacy Ratio: The capital adequacy ratio is calculated by dividing a bank's capital by its risk-weighted assets. It indicates if the bank has enough financial cushion to absorb a reasonable amount of loss so that they don't become insolvent and consequently lose depositors’ funds. 17.9% means it now at par with the top banks, and well above RBI's minimum requirement of 9%.

Recent Events:

Acquisition of Paytm Accounts: In Jan 2024,the RBI imposed a slew of restrictions on Paytm Payments Bank and barred it from undertaking various banking services, including UPI facility and fund transfers. In April 2024, Paytm completed the migration of merchant handles on its platform to YES Bank. Post this migration, YES Bank recorded over 5 million UPI transactions per month, giving it the highest market share in UPI transactions of 55%.

Cost Cutting - Layoffs: Yes Bank is undergoing a restructuring phase, resulting in the layoffs of 500 employees. More lay-offs are expected in the future as per reports.

Fund-raising through debt: The bank informed of its plans to raise funds in Indian and foreign currency through the issue of debt securities, it said. “The options could be non-convertible debentures (NCDs), bonds or Medium Term Note (MTN) among others.

A Caveat: Contingent Liabilities

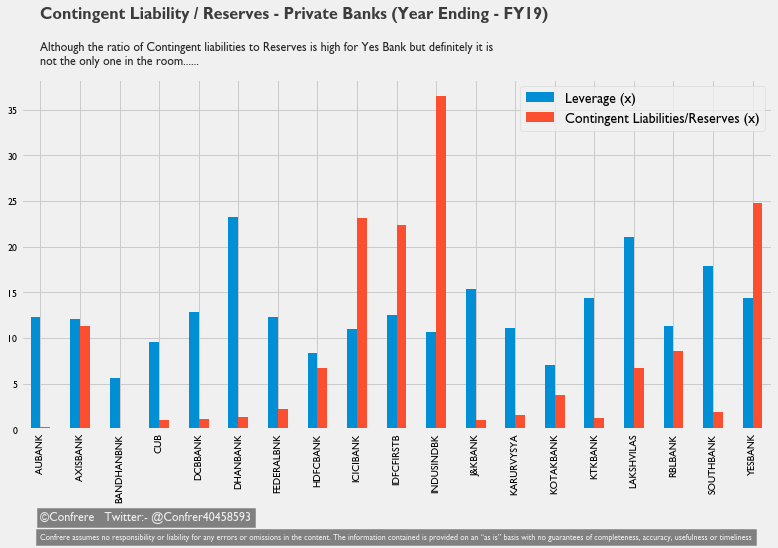

Yes Bank has contingent liabilities of INR 6.61 lac crore, that are ~1.6x its total assets. Contingent liabilities are liabilities that are contingent on the outcome of certain events.

Breakdown of Yes Bank's contingent liabilities

I tried to dig deeper into what these contingent liabilities mean, and why banks have them.

Yes Bank's contingent liabilities are largely made up of

Forward Exchange Contracts:

These are currency exchange rate forward contracts that banks hold to lock in the price of a currency pair exchange in the future.

Many of a bank's clients, such as multinational corporations and importers/exporters, have significant exposure to foreign currencies. Banks offer forward exchange contracts to these clients to help them hedge their own currency risk.

Interest Rate Swaps:

Banks use interest rate swaps to manage the risk associated with fluctuations in interest rates. For example, if a bank has issued many fixed-rate loans but has floating-rate liabilities, it might use interest rate swaps to convert its fixed-rate loan income into floating-rate income, better matching its liabilities and thus reducing interest rate risk.

They also engage in these contracts to facilitate client needs who wish to hedge their own interest rate exposure.

"The contingent liabilities of banks in India display no particular pattern and they take exposure in different components in accordance with their business strategy, risk-taking appetite and overall banking operations.

While public sector banks have a conservative stance with about 41% exposure in contingent obligations, private sector banks have followed a more liberal approach with around 110%. The volume of contingent exposure in private banks is larger due to their better expertise and risk-prone approach."

Kishore, Kamal, Indian Banks and Contingent Liabilities: A Study of Public and Private Sector Banks (February 26, 2019). The IUP Journal of Financial Risk Management, Vol. XVI, No. 3, September 2019, pp. 26-38, Available at SSRN: https://ssrn.com/abstract=3793355

Contingent Liability / Reserves for Private Banks FY 2019

This is rather old, but it indicated that there is really no pattern for the amount of contingent liabilities that bank hold as a ratio of their assets. It is largely driven by client needs and business strategy.

With that said, I've covered everything I wanted to about Yes Bank. I remember reading in an investing book (it was One Up on Wall Street if I remember correctly, but don't quote me on it) that you should be able to give a 5 minute speech on the companies you hold and why you hold them. That's my primary motivation for writing these articles.

Also, I'm NOT a SEBI registered analyst and this is NOT investment advice.

Oh my god, I’m just an engineering student and I read the whole of this article at once. Brilliantly explained in layman terms with almost 0 jargons. Loved it💯💯