A Brief History of Banking Stocks in India

Banks deposit your money safely. But more importantly, they lend money. Ideally, they lend it to those who can do something productive with it - individuals or businesses. This function is crucial in a growing economy.

When the central bank prints money (not literally), the next step is to disseminate this money to those who can make productive use of it. Productive use means making goods and services that are useful to the society. The central bank could have its employees go around the country looking for businesses that could use this money productively but that's impractical. So it lends money to banks who perform this function.

Lending and borrowing increase the pace of growth. If businesses couldn't borrow money, they would have to grow with only the excess money they had. When they borrow, they can invest in a bigger project right away, that will (hopefully) reap fruits in the future, thus accelerating growth.

Therefore, it makes sense that the performance of banks is a good proxy for the performance of an economy. BANKNIFTY, the index comprising of 12 biggest banks in India, has outperformed the NIFTY 50 by 117 percentage points between 2008 and 2024.

The value of 1 rupee invested in NIFTY v/s BANKNIFTY (2008 to 2024)

As of March 2024, India has 21 private banks, 12 public sector banks, 11 small finance banks. I'll focus on publicly listed banks, which include all but 3 small finance banks.

The Big and the Small

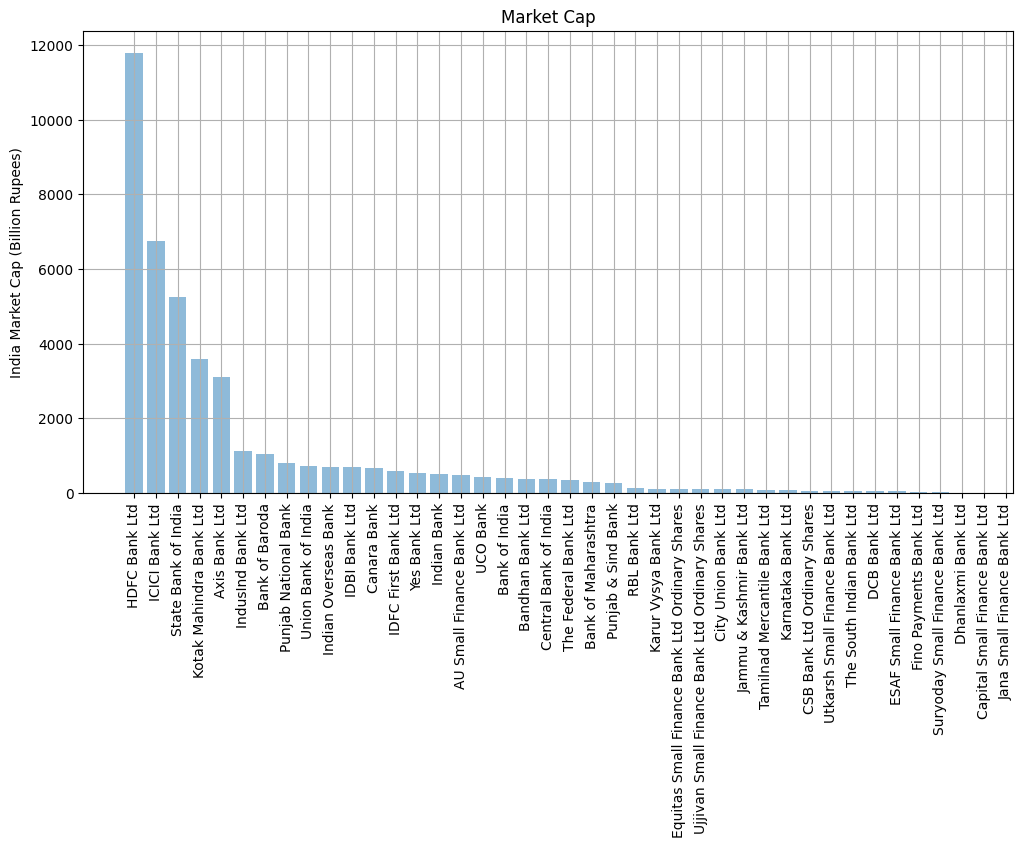

Banks by market capitalization

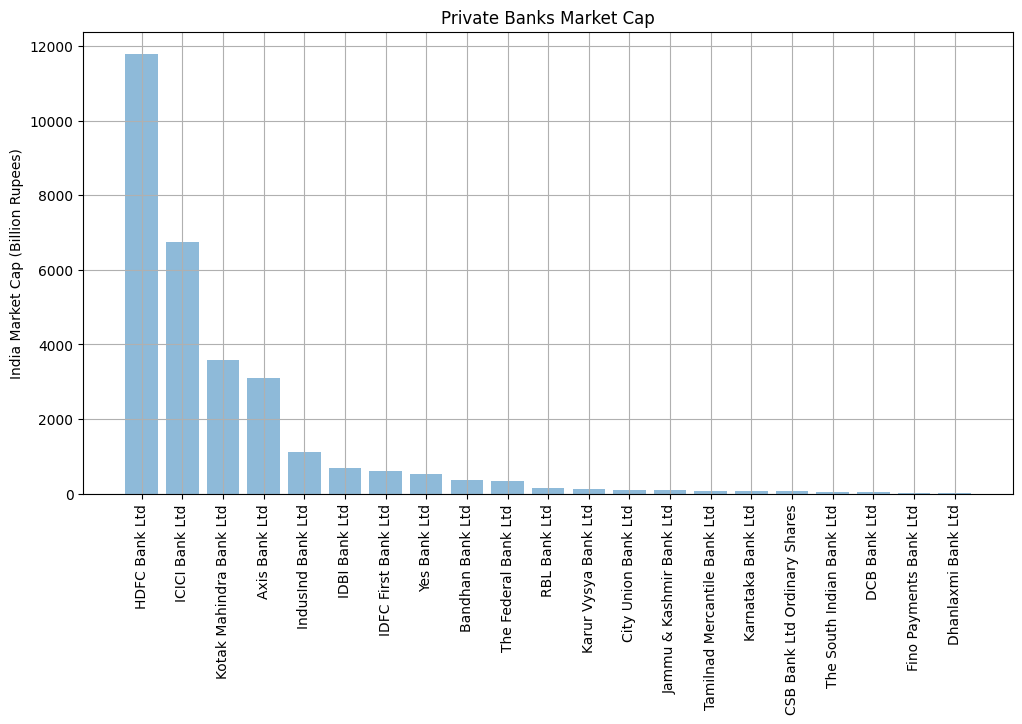

As of April 2024, HDFC Bank had a whopping market capitalization of ~₹11 trillion (11 lac cr.) or ~$140 billion, making it bigger than HSBC, and comfortably holding a place in the list of top 10 banks in the world by market cap. ICICI Bank also grew a massive ~186%. in the last 5 years, to claim the number 2 spot.

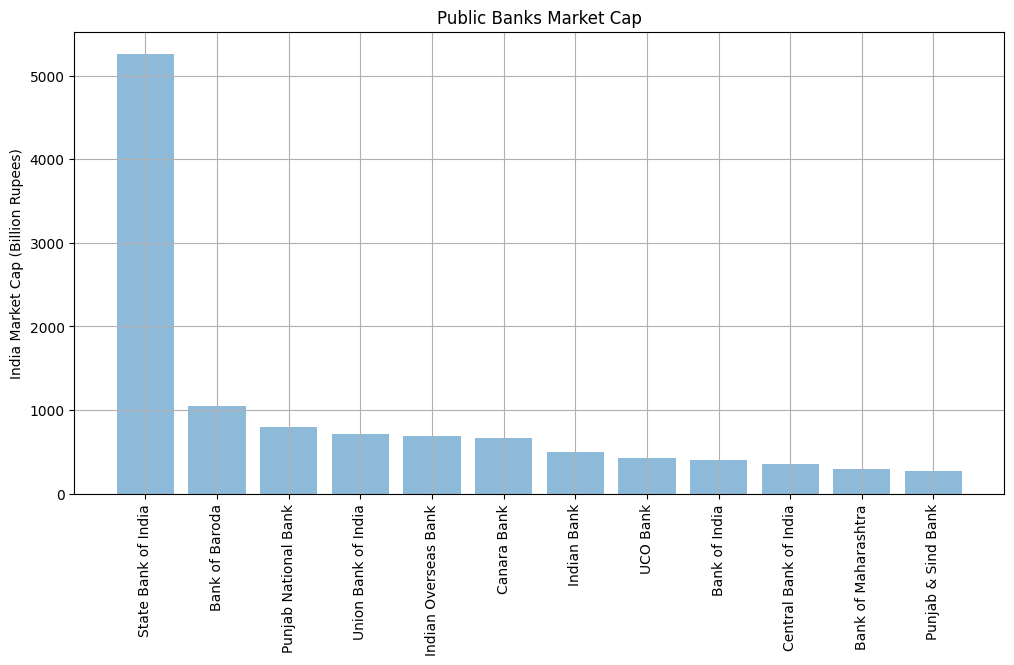

Let's look at private, public and small finance banks separately.

SBI's unprecedented price rise in the last 5 years of ~150% makes has cemented its position as the biggest public sector bank in India, with a market cap of over INR 6 lac cr.

Small Finance Banks came to prominence in 2015, when RBI granted provisional licenses to 10 entities and converted them into SBFs. AU Small Finance Bank is a clear outlier in small finance banks. I'll cover it in detail later.

Top Performers

Market Capitalization Growth of Top 5 banks

HDFC Bank still holds the crown with a comfortable margin. But notice the quick rise of ICICI and SBI over Axis and Kotak.

Next Five

Ten to Fifteen

Notice the rapid rise of public sector banks between 2022 and 2024. The Modi Government took several measures, including strengthening the management of banks, merging small banks and injecting professionalism, to help the sector.

Public sector banks were earlier known for losses running into thousands of crores of rupees and non-performing assets (NPAs), but now they are known for record profits, the prime minister said in one of his speeches.

Most small finance banks weren't event listed until 2020, with the only exception of AU Small Finance Bank, which listed in 2017.

Revenue and Income

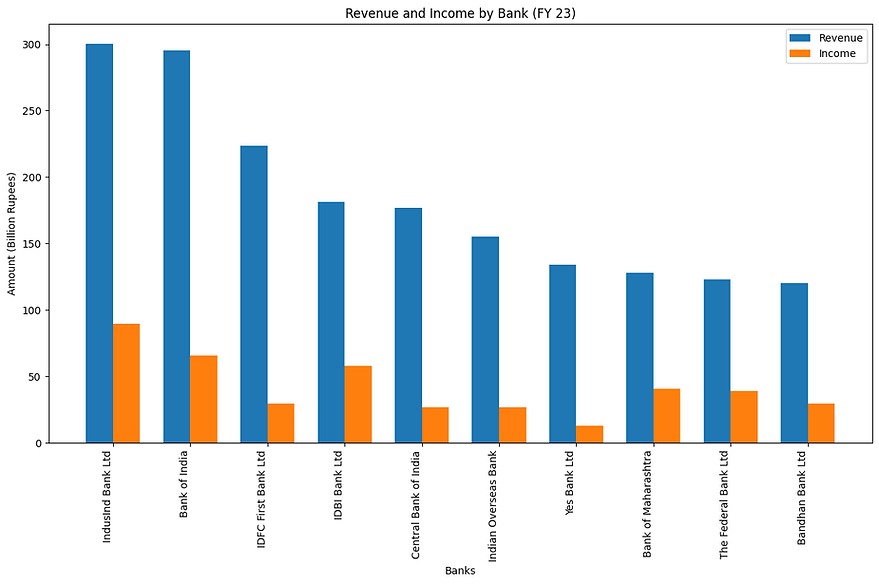

Top 10 Bank - Revenue and Net Income FY23

Notice how SBI, with a much bigger revenue still manages to make a net profit which is almost equal to that of HDFC Bank. It is a strong indicator of HDFC's operational efficiency.

Next 10

Price to Earnings Ratio

P/E tells how the market values these banks based on their earnings. A high P/E means investors expect the earnings to increase substantially.

Banks by TTM P/E

It might sometimes be misleading to look at at P/E snapshot, because a company may have a one-off bad earnings year, which would lead to high P/E. Let's look at the time-series change in P/E for some banking stocks.

HDFC Bank TTM P/E over time

SBI TTM P/E over time

Bank Nifty Historical P/E

Banks by number of branches

Clearly, public sector banks have a lot more branches than private banks, since most of them had a head start. The top private banks are slowly catching up, but still have a long way to go. It's also interesting how private banks, with much fewer branches, have a bigger revenues than their public sector counterparts.

Winners and Losers

Clearly, some banks have fared better than others. HDFC Bank and ICICI Bank are some exceptional performers in the private sector. SBI, 69 old now, is finally coming out of its public sector stereotype of a slow and incompetent enterprise to finally find comparable valuations to its private counterparts.

Let's look at HDFC Bank. A name that is almost synonymous to private banking in India.

HDFC Bank - The Famous Growth Story

In 1994, Housing Development Finance Corporation (HDFC) received an ‘in principle’ approval from the RBI to set up a private sector bank. Incorporated in August 1994 as ‘HDFC Bank Limited’, it received a banking license in January 1995.

Deepak Parekh, who at that time led HDFC, convinced Aditya Puri, who was heading operations for Citi Bank in Malaysia, to come back to India and set up HDFC Bank

HDFC Bank was an ambitious project from day one. Deepak and Aditya saw the gap in banking during the time. Foreign banks offered a wide range of products and personalized services, while public sector banks had large distribution and reach.

Mr. Puri and HDFC planned to form a bank that took the best features of both categories - and offers diversified products with a large distribution network.

HDFC Bank had an aggressive growth plans. It pioneered several banking services - credit cards, international debit cards, sms-banking, net-banking, 10-sec personal loans, and more.

It rapidly expanded its distribution network and loan book. It famously set for itself the 20% growth target. From 2002 to 2022, its advances grew more than 20% in 17 of the 20 years.

In July 2023, HDFC Bank merged with HDFC. Consequently, HDFC Bank had a market capitalisation of $154 billion, becoming the seventh most valuable bank in the world.

The bank compounded annually at a 25% annual rate since 1995 to deliver over 26,000% returns to its investors. Its return on assets (RoA) of 1.78% and return on equity (RoE) of 15.94%, are the best in the sector, complemented by a good net interest margin (NIM), which is again the best among the top 10 banks (before the merger with HDFC).

HDFC Bank Historical Share Price

ICICI Bank - A Close Second

Industrial Credit and Investment Corporation of India, ICICI was formed in 1955 at the initiative of the World Bank, the Government of India and representatives of Indian industry. ICICI Bank was established by ICICI, as a wholly owned subsidiary in 1994.

In the 1990s, ICICI transformed its business from a development financial institution offering only project finance to a diversified financial services group, offering a wide variety of products and services

ICICI Bank's exceptional growth is often credited to its knowledge management strategy initiated in the year 2000. The bank adopted a strategy of linking technology with infrastructure through corporate intranet, ICICI universe which provide a platform for employee to habituate towards technological utilizations.

The bank had a net profit of ₹40,888 crore (US$ 4.9 billion) in FY2024 as its loan book grew by 16.8% year-on-year to ₹11,50,955 crore (US$ 138.0 billion) and Net NPA ratio declined to 0.42%.

https://www.iosrjournals.org/iosr-jbm/papers/Vol16-issue1/Version-4/D016142537.pdf

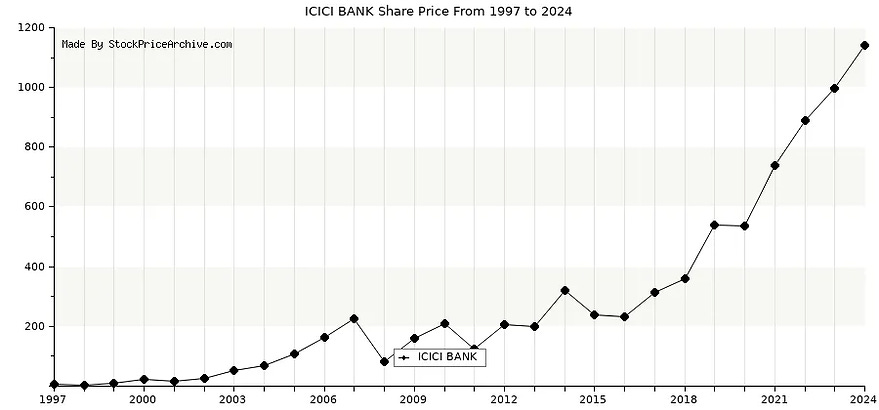

ICICI bank returned a whopping ~17,000% between 1997 and 2024, compounding at a rate of ~21%.

ICICI Bank Historical Share Price

Yes Bank: Rise, fall, and resurgence?

The Rise

Yes Bank Ltd. was incorporated on November 21, 2003 by Rana Kapoor and late Ashok Kapoor.

The Bank got the certificate of commencement of business on January 21, 2004. In the year 2005, they forayed into retail banking with the launch of the International Gold and Silver debit card in partnership with MasterCard International. In June 2005, they came out with the public issue and their shares were listed on the stock exchanges.

On 31st March 2014, Yes Bank book of accounts reflected loan as 55,633 crores, and the deposit book data was 74,192 crores.

Yes Bank went on a loaning spree. Its total advances rose by 334% between FY14 and FY19, the very best rise among comparable banks within the period. Since then loan growth increased highly and went to 2.25 trillion as of Sept 30 of 2019.

The Fall

The Asset quality of the bank worsened. Global financial company UBS wrote, "Yes bank is giving stressed loans to such companies which cannot repay the loan in time. It was a high risk taken by Yes Bank. Such loans are called bad loans."

Anil Ambani's Reliance, DHFL, Jet Airways, IL&FS, Essel Group were among the borrowers who received loans during the aggressive lending spree.

RBI Intervention

In March 2020, RBI intervened. A 30 day moratorium was imposed on Yes Bank during which depositors were allowed to withdraw only up to Rs.50,000 per person and up to 5 lakhs in medical or emergencies.

Overall Bank management was taken over by the Reserve Bank of India.

The RBI announced a draft ‘Scheme of Reconstruction’ that entailed the State Bank of India (SBI) investing capital to acquire a 49% stake in the restructured private lender. Yes Bank was saved.

Resurgence?

When RBI intervened, Prashant Kumar was made CEO. By March 2020, The gross non-performing assets (GNPAs) for Yes Bank had surged to 16.8 percent as a portion of its total advances; double that of the level for all banks in India.

As loans and credit flow worsened in the banking system since 2019, Yes Bank had seen a sharp 39 percent erosion in deposits in nearly 12 months: From Rs 227,601 crore in March 2019 to Rs 137,506 crore as of March 5, 2020.

Kumar and his team managed to reduce GNPAs to 13.4 percent as of June 30, 2020.

It proposed a transaction where Rs 48,000 crore of the bad loan pool would be transferred to an asset reconstruction company (ARC) set up by Yes Bank and JC Flowers. It completed this transaction in March 2022, which was the single largest transaction of sale of non-performing assets in the Indian Banking System.

In 2022 it also approved the allotment of equity shares and warrants of ~INR 8,887 crore (~US$1.1bn) through a preferential issue to private equity investors - Carlyle and Advent International.

Yes Bank turned profitable in FY22, the first time since the lifting of the moratorium, as provisioning on loans came down.

For FY24, Yes Bank posted

Net Advances at INR 2,27,799 Cr, up 12.1% Y-o-Y

Total Deposits at INR 2,66,372 Cr, up 22.5% Y-o-Y

Net Interest Income at INR 8,095 Cr up 2.2% Y-o-Y

Net Profit at INR 1,251 Cr up 74.4% Y-o-Y

Net NPAs at 1.1% in Q4FY24 v/s. 1.7% in Q3FY24

Everything seems to be going on the right track. They sold bad loans, and raised fresh capital to infuse cash into the system. They decreased net NPAs, increased deposits and advances, and came back to profitability. From May 2023 to May 2024, It's stock price is 40% up from around ~Rs 16 to ~ Rs 22.

So what's stopping the price from shooting further up, and back its glory days of Rs 400?

Well, two things

The recovery isn't complete yet. For perspective, In FY24, Federal Bank had a net profit of INR 3,721 Cr on a revenue of INR 25,267 Cr, while Yes Bank had a net profit of INR 1,251 Cr on a revenue of 32,961 Cr.

Contingent Liabilities: Yes Bank has contingent liabilities of Rs 6.6 lakh crore, that are ~1.8 times its assets. Contingent liabilities are liabilities that may occur depending on the outcome of an uncertain future event. For perspective, HDFC Bank's ratio of contingent liabilities to assets in 0.75. Yes Bank's contingent liabilities are made up of forward exchange contract, interest rate swaps, foreign exchange contracts and other guarantees.

https://blog.ipleaders.in/analysis-yes-bank-crisis/

Yes Bank Historical Share Price

AU, and the emergence of Small Finance Banks

In July 2014, the Reserve Bank of India (RBI) released the draft guidelines for small finance banks, seeking applications from interested entities.

In 2015, RBI announced that it had given provisional licenses to ten entities who would have to convert into small finance banks within one year.

Eight out of these ten entities were microfinance NBFCs, reiterating RBIs agenda of financial inclusion. Capital Small Finance Bank was the first small finance bank to begin operations, opening with 47 branches on 24 April 2016.

The objective of SFBs is to address the financial needs of the unbanked and underbanked segments of society.

https://www.pwc.in/research-and-insights-hub/shifting-gears-to-drive-financial-inclusion.html

Revenue and Net Income of SFBs (FY23)

AU Small Finance Bank

Originally incorporated as L.N. Finco Gems Private Limited in 1996, the company name was changed to Au Financiers (India) Private Limited in 2005 to reflect its diversified finance business.

It was granted the in-principle approval to establish an SFB by the RBI, pursuant to its letter dated October 7, 2015. Pursuant to being established as an SFB, the name of the Company was changed to AU Small Finance Bank Limited in April 2017.

AU Small Finance Bank has demonstrated an impressive performance, achieving a remarkable 54% CAGR in deposits and a 34% CAGR in loans from FY18 to FY23. This growth has solidified its position not only within the Small Finance Bank (SFB) sector but also across the broader mid-cap banking landscape.

The bank’s success can be attributed to its strategic expansion of new product offerings, a broader geographical footprint, substantial investments in technology, and a determined focus on physical expansion.

AU Small Finance Bank Price Chart (2017 to 2024)

PNB and Public Sector Banks

Rich History:

PNB was established in modern-day Lahore, Pakistan, in 1894, and has coursed through several crests and troughs over its more than 120 years of existence.

Lala Yodh Raj, then head of PNB, shifted the head office of the bank from West Punjab which was to go to Pakistan to Underhill Road in Delhi in June 1947, just months before the partition in 1947.

In 1951, the bank took over the assets and liabilities of Bharat Bank Ltd. and became the second largest bank in the private sector. The Government of India nationalized PNB and 13 other major banks on 19th July 1969.

Frauds

The bank’s rich history has been tarnished by the $ 1.77 billion (over ₹1,000 crore) fraud it reported in 2017.

Based on the data available with RBI, among state-run banks in India, PNB topped in the number of loan fraud cases across India. With 389 cases totaling ₹ 65.62 billion over the last five financial years.

Recent performance

Between May 2022 and May 2024, the stock's price jumped ~300%.

Between 2019-2023, the bank's advances have grown at a CAGR of 13.8%. Asset quality improved, as net NPAs halved, falling from 11.2% in the financial year ending 2018 to 0.99% in FY23.

Punjab National Bank Historical Share Price

PNB's story is representative of the larger story of public sector banks. Most of them have been around for a long time, establishing a wide distribution network with thousands of branches.

But they've been infamous for their incompetence, inefficiency, and frauds. They've been involved in some of the biggest scams and have been generally inefficient in terms of operations.

They offered poor customer service, had slow growth, and lacked innovation in terms of the products they offered. This is reflected in their prices compared to those of private banks.

After the emergence of private sector banks in 1995, the sector became more competitive. HDFC, UTI (now Axis Bank), ICICI started from scratch and grew rapidly, to outperform public sector banks. They offered a wide range of products, better customer service, and innovative solutions like net-banking.

The government's recent efforts to improve public sector banks have resulted in some positive outcomes. Fewer cases of fraud, improving asset quality, and better corporate governance are being recognized by the market.

The NIFTY PSU Bank Index has outperformed the NIFTY PRIVATE BANK Index by a huge margin in FY24.

The value of 1 rupee invested in NIFTY PSU BANK v/s NIFTY PRIVATE BANK (FY24)

What next?

New players like payments banks have emerged. A payments bank is like any other bank, but operating on a smaller scale without involving any credit risk. In simple words, it can carry out most banking operations but can’t advance loans or issue credit cards.

Payment Banks make money by putting the money deposited with them by their customers in deposits in other banks. A payments bank pays a lower interest rate to its customers on their deposits than what it earns on deposits placed with other universal banks.

As RBI struggles to keep pace with these developments, it is trying to make sure that regulations are not too restrictive, while also ensuring responsible lending.

Recently, the Reserve Bank of India (RBI) has imposed strict restrictions on Paytm Payments Bank Ltd (PPBL). This move comes after an audit report highlighted persistent non-compliances and supervisory concerns within the bank.

As India is set to grow steadily at 7-8%, it will be interesting to see how public, private and small finance banks fare in this era of growth, as India eyes the spot for the 4th largest economy in the world.