Quant India - A Systematic Equities Strategy for Indian Retail Investors

A systematic strategy to avoid large drawdowns during bear markets and maximize risk-adjusted returns during bull markets.

Why do we need a systematic strategy?

So far, with my own investing journey - where I manage my own and my family’s assets, the decision making has been largely based on intuition, news, and some high-level research. As I spent the last few years working as a quant and learning more about systematic, data-driven, and algorithmic strategies - I realized how naive it is to make investment decisions based on intuition and loose research. Even though my portfolio has fared pretty well, there is no way I can prove statistically that I am a good stock picker or portfolio manager. Which is another way to say, that there is no way for me to say that my performance has not been simply driven by luck.

To be precise, I wouldn’t be able to answer the following questions:

What is my investment strategy?

What are the absolute returns, and how how do they fare against the benchmark?

How do I attribute my returns - additional risk or mispricing?

What is the market beta of my portfolio?

What is the Sharpe Ratio of my portfolio?

How do I measure risk? What risk management processes do I have in place?

How big are the drawdowns?

Maybe, some of these questions can be answered by looking at historical data for my portfolio, but it is still a tedious task because

It involves contributions and withdrawals made at random points in time

It involves sporadic buy and sell transactions with no specific frequency

I felt it was a shame to call myself a quant, and not be able to answer these questions about my own investment methods while I advised other people on financial markets. So, I decided to create a systematic equities strategy that is defined clearly, is largely algorithmic, and whose performance I can document effectively.

Quant India Investment Strategy

I call the strategy - ‘Quant India’, and it primarily serves two purposes

Asset Allocation: Avoid large drawdowns through effective asset allocation during bear markets

Stock Picking: Make the most of bull markets by creating a portfolio of 20 stocks based on quality and momentum features

The rest of the article explains this strategy in detail. I’m also working on making the portfolio and its performance metric public by hosting it on a streamlit web-app, for which I will share the link soon.

Quant India Strategy Details:

Universe: All stocks and ETFs on NSE

Rebalance Frequency: Monthly

Portfolio:

20 stocks during bull markets

Gold / Foreign Equity / Debt ETFs during bear markets

Benchmark Index: BSE 500

Portfolio Creation Date: 7th March, 2025

Now, I’ll describe what exactly the strategy is, and how it works:

Part 1: Asset Allocation

I’d argue that asset allocation is the most important decision in creating your investment portfolio—more than stock picking. When people analyze Warren Buffett’s investing success, they often focus only on his stock-picking skills. But they overlook other crucial factors behind Berkshire Hathaway’s returns—such as asset allocation (holding cash during expensive markets), leverage (via insurance float), and the economic environment (Buffett’s career coincided with one of the most prosperous growth phases in U.S. history).

For Indian retail investors, managing macroeconomic risk is critical. Remember that Japan went through a "lost decade" with 0% stock returns. Assuming such a scenario can't happen in India is naive. While we can't forecast macro events accurately, we can try to identify when we’re in one and adjust exposure accordingly—by allocating to gold, foreign equities, and debt.

The goal of our asset allocation methodology is to dynamically adjust exposure to Indian equities, foreign equities, gold, and domestic debt using indicators readily accessible to Indian retail investors.

Asset Classes:

1) NIFTY 50 – Indian Equities

2) S&P 500 / NASDAQ 100 – US Equities

3) Hang Seng – Hong Kong (China) Equities

4) Gold

5) Govt Debt – GILT Funds

Asset Allocation Process:

Predict months with potential for large drawdowns in Indian markets.

If drawdown prediction exceeds a 2% threshold, diversify out of Indian equities.

Predicting Returns for Indian Equities:

We use the following features to predict next-month drawdowns in NIFTY 50:

CAPE Ratio

USD/INR Exchange Rate

Price Momentum

A random forest model trained on monthly data uses these features to forecast whether NIFTY 50 will fall by more than 2% in the upcoming month.

If no drawdown is predicted → 100% allocation to the stock portfolio.

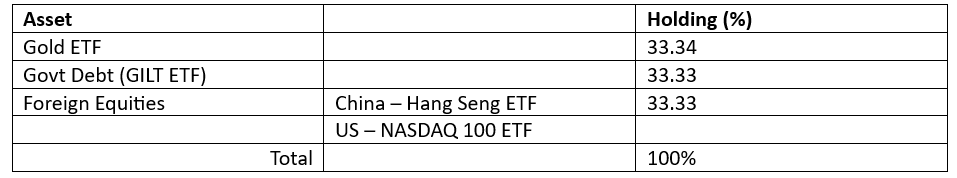

If drawdown is predicted → Allocation shifts to gold, debt, and foreign equities. This portfolio is defined as follows:

Part 2: Stock Picking

SQSM – Sector-Quality-Small-Momentum Strategy

This is an overview of the process with defines the construction of the factor portfolios to which we will allocate when our regime prediction model does not predict a large drawdown. We will create a portfolio of 20 stocks which will be updated every month.

We use the following factors to pick the 20 stocks:

Momentum

Quality

Value

Note that the size factor is used as a filtering mechanism, while ranking is only based on the remaining three factors. Also, we do not use these factors separately to identify and rank stocks, instead we an aggregate score based on the combination of these factors to create a single ranking system.

The step-by-step process along with code snippets is described in the article below:

It’s also important for me to mention that this is not complete work. I wish to improve the strategy continuously, and especially make it more and more automated by eliminating the parts that are still not completely data-driven. The idea is to create a system of models that would work together to create a portfolio that is updated every month - with little to no human intervention.

References

1) Frazzini, Andrea and Kabiller, David and Pedersen, Lasse Heje, Buffett's Alpha (January 9, 2019). Financial Analysts Journal, 2018, 74 (4): 35-55, Available at SSRN: https://ssrn.com/abstract=3197185 or http://dx.doi.org/10.2139/ssrn.3197185

2) Asness, Cliff S. and Frazzini, Andrea and Pedersen, Lasse Heje, Quality Minus Junk (June 5, 2017). Available at SSRN: https://ssrn.com/abstract=2312432 or http://dx.doi.org/10.2139/ssrn.2312432